- Define invoice approval manual#

- Define invoice approval verification#

- Define invoice approval series#

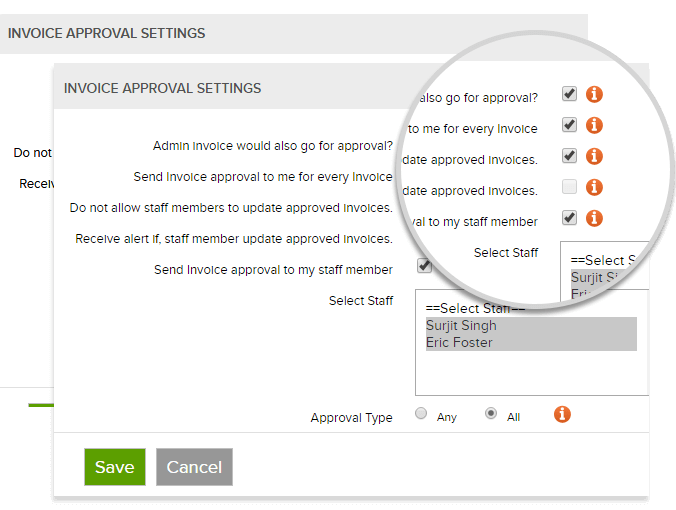

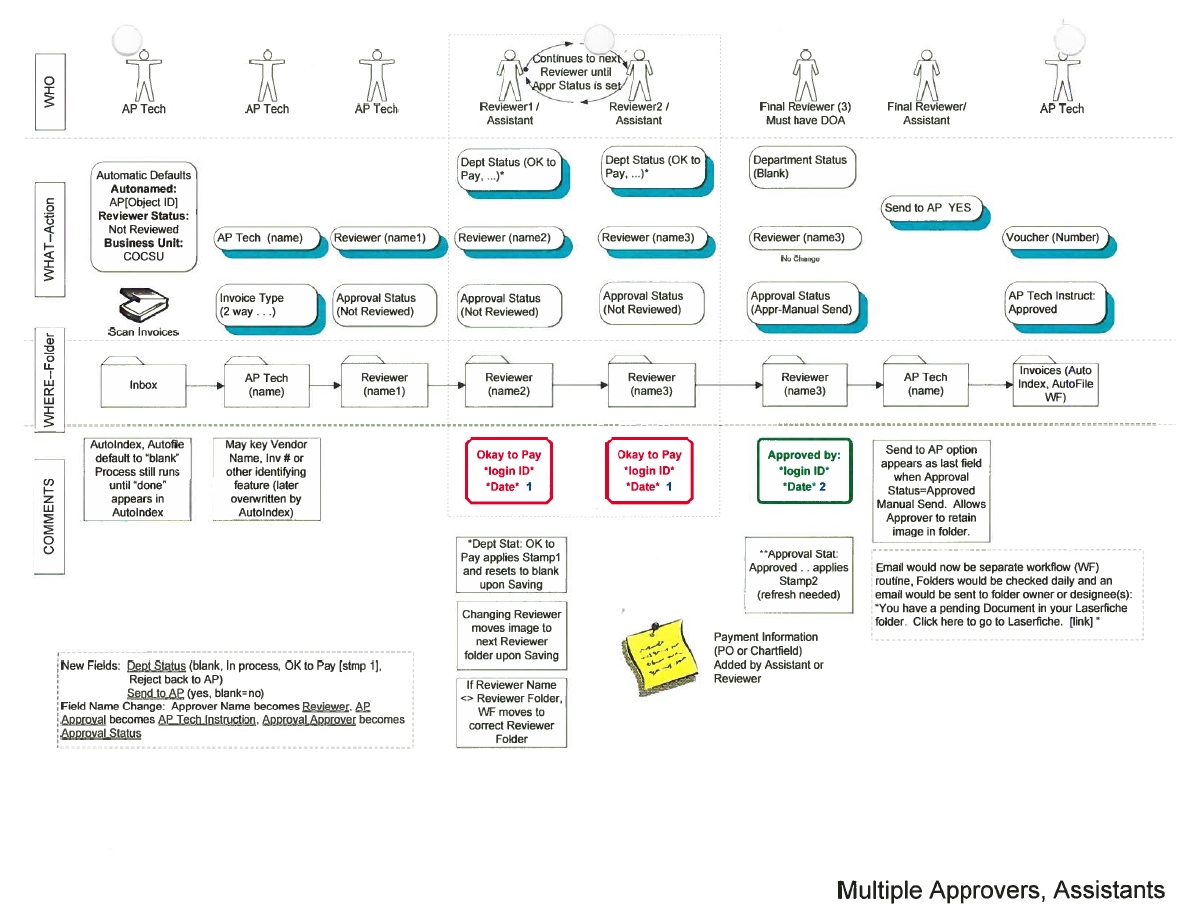

Good business practice encourages communication to the vendor that a payment is in process with an estimated lead time. With the invoice verified and the amount to be paid approved by the appropriate party, the amount due to the vendor can be processed. Who determines the approval should be clearly defined: Smaller amounts may have pre-authorization for defined business needs whereas larger amounts may require the approval of a manager or executive team member. Once the information on the invoice has been corrected and is verified, the invoice is approved. However, where there is pushback, further action may need to be taken including involving executive level stakeholders to resolve the issues. Sometimes this is just a matter of contacting a vendor's AR department and requesting that the information be corrected. Where a piece of data from the invoice does not match, more information must be gathered.

Define invoice approval verification#

What exactly those touch points are will vary depending on the size of a project or frequency of vendor interaction, however, they should always include: vendor name and contact, invoice amount, line items including unit cost, quantity and subtotal, invoice number or PO number, payee data including payment type and relevant routing information, and any relevant due dates including rebate windows.īusinesses refer to this verification as a two- or three-way invoice matching because the invoice is compared to a purchase order, a packing slip or delivery confirmation, and sometimes a purchase requisition. Once an invoice has been received, a number of pieces of information on the invoice should be reviewed.

Explaining the invoice approval workflow Verify the invoice

Define invoice approval series#

As a series of steps or checks that an invoice undergoes before payment is sent, the workflow becomes a risk reduction system that supports sustainable vendor relationships as well as transparent, proactive bookkeeping. Invoice approval workflow is a process that a company undertakes to ensure that AP is paying the correct amount-to the correct vendor-at the correct time. However, the regrettable reality of scammers and misplaced numbers means that processing invoices takes more than just a quick glance. And many, if not most, invoices that come into an accounting department are just that-error free and ready to be reconciled. Ideally, when an invoice is received, all of the information will be accurate and payments will be processed in a timely manner.

Define invoice approval manual#

Even if you already have an established workflow in place, now is the time to audit and affirm that invoices are being reviewed before payments are made with a keen consideration for introducing AP automation that improves delays introduced in a manual approval process.

The effects of not having a sustainable invoice workflow impact businesses of all sizes, and the FBI has urged US businesses to take precautions around invoice approvals.

Heightened awareness of business email compromise (BEC) fraud soared during 2020 a trend that has carried over into 2021. Learn more about what an invoice approval workflow is and how AP automation streamlines and secures that process. Scammers take advantage of manual invoice processing, leaving finance teams in the lurch. US businesses lost nearly $2 billion in invoice fraud in 2020 alone.

0 kommentar(er)

0 kommentar(er)